Working: 9.00am - 7.00pm

Working: 9.00am - 7.00pm

SOC 1 is a globally recognized attestation framework developed by the American Institute of Certified Public Accountants (AICPA) that evaluates how organizations design and operate controls relevant to internal control over financial reporting (ICFR). A SOC 1 report demonstrates that an organization has implemented effective controls that impact its customers’ financial statements, ensuring accuracy, completeness, and reliability of financial reporting processes.

SOC 1 Compliance in Indonesia is critical for service organizations such as payroll processors, accounting and finance outsourcing firms, fund administrators, payment processors, ERP service providers, and shared service centers that support client financial reporting activities. SOC 1 compliance is achieved through an independent third-party attestation, where a licensed CPA firm evaluates whether the organization’s controls are suitably designed (SOC 1 Type I) and operating effectively over a defined period (SOC 1 Type II). A SOC 1 report provides assurance to customers, auditors, and regulators that financial reporting controls meet internationally accepted standards.

To meet the requirements of the SOC 1 framework, organizations typically require structured, end-to-end support covering scope definition, risk assessment, control identification, documentation, evidence management, readiness assessment, and audit coordination. VerosCert delivers comprehensive SOC 1 readiness and attestation support through a proven consulting methodology that begins with assessing controls relevant to financial reporting and continues through control documentation, implementation support, internal testing, and audit preparedness. VerosCert works closely with management, finance, compliance, and operational teams to ensure SOC 1 controls are practical, auditable, and aligned with business processes, enabling organizations to successfully complete SOC 1 Type I or Type II attestation while strengthening financial control assurance and client confidence.

We begin with a SOC 1 gap analysis to assess existing controls relevant to financial reporting against SOC 1 requirements. Focused awareness sessions help teams understand control objectives, audit expectations, and their role in maintaining reliable financial reporting controls.

We assist in developing SOC 1-aligned policies, procedures, and control documentation covering financial processes, access controls, and change management. Controls are embedded into daily operations to ensure they are practical, auditable, and consistently applied./p>

Before the audit, we perform a SOC 1 readiness assessment to validate control design and evidence related to financial reporting. Gaps are identified early, and corrective actions are guided to ensure readiness for SOC 1 Type I or Type II attestation.

VerosCert manages end-to-end SOC 1 audit coordination with licensed CPA firms, supporting scope finalization, evidence submission, and auditor interactions to ensure a smooth attestation process and a reliable SOC 1 report.

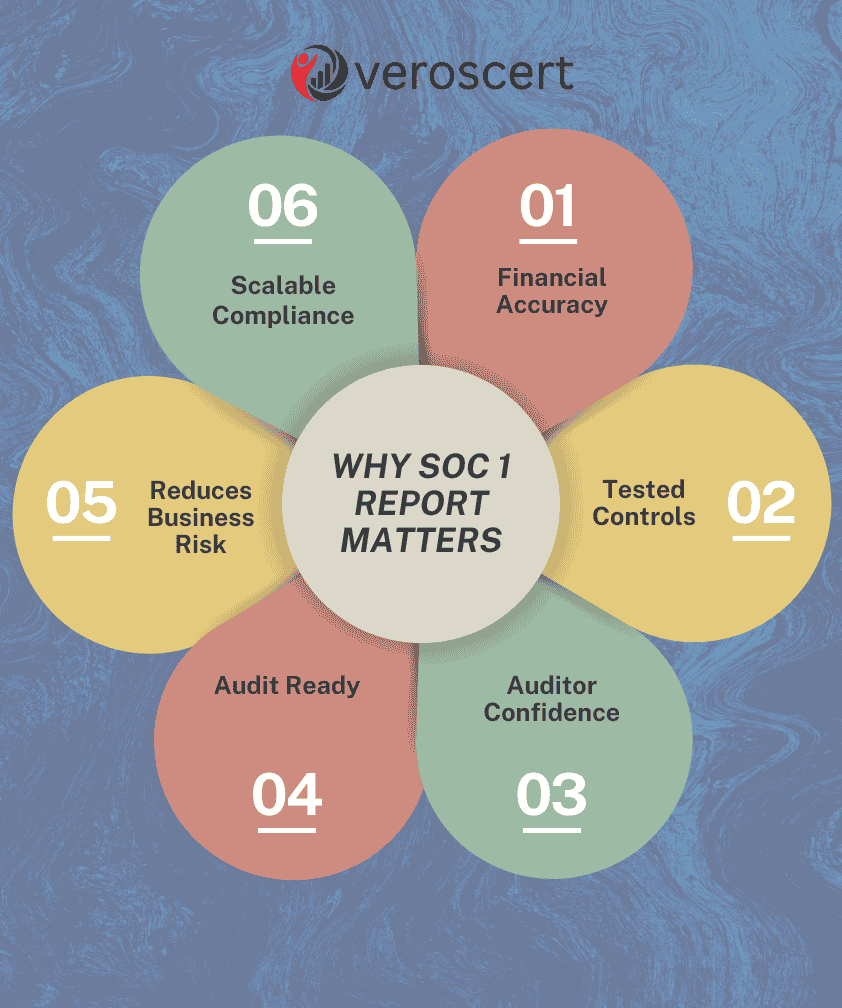

At VerosCert, we approach SOC 1 compliance as more than an audit requirement—it is a structured framework for strengthening financial reporting integrity, operational accountability, and auditor confidence. By helping organizations understand and implement SOC 1 control principles, we ensure the SOC 1 journey delivers measurable improvements in internal controls over financial reporting (ICFR). These principles form the foundation of a reliable, audit-ready SOC 1 report.

Establish a strong control environment that demonstrates management’s commitment to accurate and reliable financial reporting, with clear accountability and governance across financial processes.

Engage leadership and ensure employees understand their responsibilities for maintaining financial reporting controls, supporting consistency, accuracy, and audit readiness.

Identify and assess risks that could impact financial reporting and design controls that mitigate errors, misstatements, and operational weaknesses in line with SOC 1 requirements.

Align SOC 1 controls with applicable regulatory obligations and external audit expectations, supporting compliance while strengthening confidence with customers and auditors.

Continuously monitor and test financial controls to ensure they operate effectively over time, supporting both SOC 1 Type I and Type II attestation requirements.

Establish structured procedures to identify, investigate, and resolve control failures or financial reporting exceptions in a timely and controlled manner.

Extend SOC 1 controls to relevant suppliers and third-party service providers, ensuring outsourced processes impacting financial reporting are properly managed and monitored.

SOC 1 compliance costs in Indonesia vary based on your organization’s size, operational complexity, scope of services, and current maturity of controls relevant to financial reporting. At VerosCert, we offer transparent and competitive SOC 1 pricing tailored for service organizations, startups, SMEs, and growing enterprises, with no hidden costs. Our approach helps organizations achieve SOC 1 Type I or Type II attestation efficiently while meeting customer, auditor, regulatory, and contractual expectations. We also provide flexible engagement models for companies pursuing SOC 1 alongside frameworks such as SOC 2 or ISO 27001. Contact us for a no-obligation SOC 1 cost estimate and a clear attestation roadmap.

Achieving SOC 1 compliance in Indonesia is a structured process focused on designing, implementing, and validating controls relevant to financial reporting. At VerosCert, we follow a 6-step SOC 1 readiness and attestation process to help organizations successfully obtain SOC 1 Type I or Type II reports. With the right scope and preparation, organizations can complete SOC 1 readiness efficiently and progress smoothly toward attestation.

1 st

2 nd

3 rd

4 th

5 th

6 th

As Indonesia continues to strengthen its position as a regional hub for finance, shared services, outsourcing, and technology-enabled service providers, assurance over financial reporting controls has become a critical business requirement. SOC 1 compliance helps organizations demonstrate effective internal controls over financial reporting and meet increasing assurance expectations from clients, auditors, and regulators.

Years of Experience

Skilled Consultants

VerosCert is a trusted partner for SOC 1 compliance and attestation in Indonesia, helping service organizations design, implement, and maintain effective internal controls over financial reporting (ICFR) that support accuracy, reliability, and audit confidence. With strong expertise in SOC 1 requirements and a structured consulting methodology, we guide organizations through every stage of the SOC 1 journey—from scope definition and risk assessment to control identification, documentation, implementation, evidence management, readiness assessment, and audit coordination. Our approach enables organizations to reduce financial reporting risks while meeting client, auditor, regulatory, and contractual expectations in Indonesia’s compliance-driven and finance-focused business environment. VerosCert works closely with licensed and independent CPA firms to support successful SOC 1 Type I and Type II attestation. In addition, through partnerships with training and assurance organizations, we deliver practical SOC 1 control-awareness and audit-readiness programs that equip finance, compliance, and operations teams with the skills required for ongoing compliance, audit preparedness, and sustainable financial control operations. At VerosCert, we go beyond attestation by helping Indonesia-based organizations build robust financial control environments that support transparency, client assurance, and long-term business resilience.

Clients Across Sectors

International Standards

Driven By Vision